We would like to know about No Credit Check Loans Guaranteed Approval, so that I will tell you in detail in this blog.

In the digital age, if you find yourself amongst the throngs of borrowers needing quick cash to tackle an unforeseen expense, you might be scouring the internet for viable options.

However, if you are burdened with a bad credit score, you could grapple with many obstacles while trying to secure a loan. The dreaded word “no” could resound through your ears, echoing from many lenders, leaving you feeling helpless and hopeless. Even if you land a loan, its high-interest rates could cause further financial distress.

Your credit score is the key determinant of your loan approval, thereby underscoring the criticality of rectifying a poor score, lest you fall prey to this cycle of frustration and despair.

Typically, conventional loans, credit lines, secured loans, and even credit cards cater to borrowers with commendable credit scores. However, those with meager or inadequate credit history often need a bad credit loan to alleviate unforeseen financial emergencies. Nevertheless, caution is imperative when selecting a loan option, as it could lead to destructive issues such as fraudulent practices, subpar customer service, or exorbitant interest rates.

You may also like : Chatgpt Error In Body Stream

Top 3 No Credit Check Loans Guaranteed Approval

- OppLoans

- CashUSA

- MoneyMutual

Let’s understand them one by one.

1- OppLoans

Overall Best No Credit Check Loans Guaranteed Approval

In recent years, online lending has become a popular alternative to traditional banks for consumers wanting quick and easy access to finances. OppLoans is one such lender offering personal loans to people with less-than-perfect credit. In this article, we’ll go over OppLoans in detail, including its history, loan options, the application process, fees, and customer service so that you can make an informed decision about your next lender.

No Credit Check loan guaranteed approval direct lender

Background

OppLoans was formed in 2012 to assist individuals in improving their financial situations. OppLoans, in contrast to many other online lenders, concentrates on helping consumers with weak or no credit history, which makes acquiring loans from traditional banks difficult. The Better Business Bureau has given the company an A+ rating, and it is situated in Chicago.

Loan Options

OppLoans offers personal loans ranging from $500 to $5,000, which can be used for various purposes, such as car repairs, medical bills, or home improvements. The loans have a repayment term of 9 to 24 months, with fixed interest rates ranging from 59% to 199% APR, depending on the borrower’s creditworthiness. OppLoans also offers a line of credit product, allowing borrowers to access funds as needed.

Application Process

Guaranteed loan approval no credit check

The OppLoans personal loan application process is quick and uncomplicated. Applicants can apply online or by phone and expect a decision within minutes. Borrowers must give basic personal information, such as their name, address, social security number, and work and income information, to apply. OppLoans also requires a bank account in the borrower’s name to transfer payments.

Fees

OppLoans charge up to 3% of the loan amount as an origination fee, which is taken from the loan profits. Borrowers can pay off their loans early without additional expenses because the organization does not levy prepayment penalties. However, the high-interest rates on OppLoans loans can be costly, so consumers should assess the entire cost of borrowing before applying.

Customer Service

OppLoans takes pride in offering exceptional customer service. Borrowers can contact customer service weekly via phone, email, or live chat. The firm also includes a resource center with instructional content on personal financial matters on its website.

Pros and Cons

| Pros | Cons |

|---|---|

| Easy application process | High interest rates |

| Quick funding | Origination fees |

| No prepayment penalties | Limited loan amounts |

Conclusion

OppLoans is a reputed online lender offering customers personal loans with less-than-perfect credit. While the company’s interest rates and costs may be higher than traditional lenders, its simple application procedure, speedy funding, and exceptional customer service make it a fantastic alternative for people who need cash immediately. When asking for a loan, evaluate the real cost of borrowing and your capacity to repay.

2- CashUSA

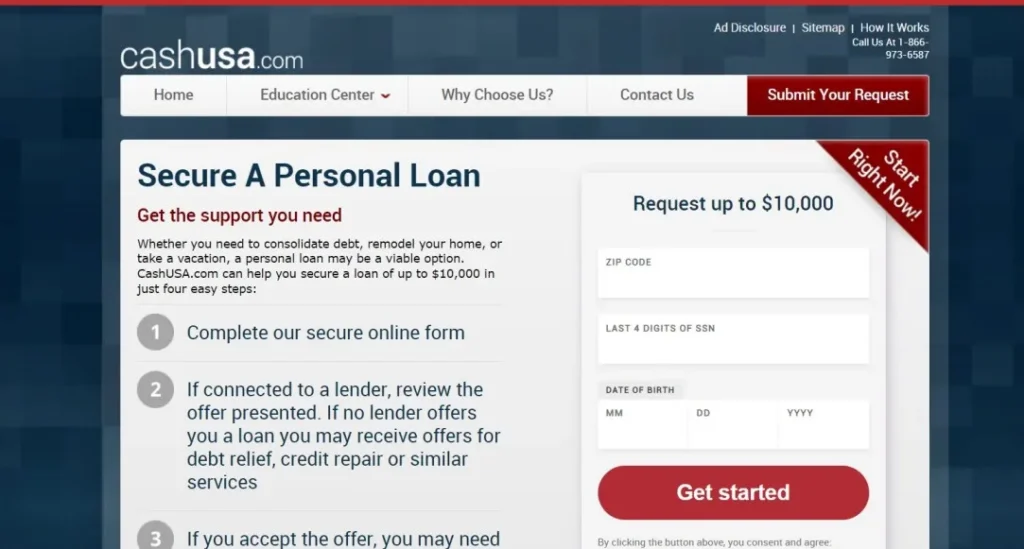

Do you require a rapid loan yet require extra time to go through the drawn-out and drawn-out procedure of conventional banks? The greatest option for you is CashUSA. Via its online lending marketplace, CashUSA, lenders can quickly and easily offer loans to needy people. This article will discuss CashUSA and what it is, how it functions, and what it has to offer.

What is CashUSA?

Using the internet lending marketplace CashUSA, consumers can get loans up to $10,000 from lenders. Since the company’s founding in 2005, it has assisted thousands of borrowers in getting the money they require promptly and easily. As a link between borrowers and lenders, CashUSA is not a direct lender.

How Does CashUSA Work?

CashUSA connects borrowers with a network of lenders who can provide the requested loan amount. The process is straightforward. The borrower starts by filling out a loan request form on the CashUSA website. This form will ask for basic information, such as name, address, and employment details.

Once the loan request form is completed, CashUSA will match the borrower with a lender who meets their requirements. The lender will then contact the borrower and provide the terms and conditions. If the borrower accepts the terms, the loan is processed, and the funds are deposited into the borrower’s bank account.

Benefits of Using CashUSA

There are several benefits of using CashUSA for your online loan needs:

- The loan process is quick and easy; you can receive funds within 24 hours of approval.

- The online platform is easy to use and is available 24/7, making it convenient for borrowers to apply for loans anytime and anywhere.

- CashUSA has a large network of lenders, increasing the chances of finding a lender who can provide a loan that meets the borrower’s requirements.

Eligibility Criteria of CashUSA

Be a U.S. citizen or permanent resident

Be at least 18 years old

Have a regular source of income

Have a valid checking account

Loan Process of CashUSA

The application process for loans with CashUSA is simple. Upon completion of the loan request form by the borrower, CashUSA will match them with a lender who satisfies their criteria. The lender will then contact the borrower and give them information about the loan’s parameters, including its size, interest rate, and repayment schedule.

If the borrower agrees to the terms, they will need to provide electronic signatures on the loan agreement. The lender will then process the loan and deposit the funds into the borrower’s bank account within 24 hours.

Repayment Process of CashUSA

Loans obtained from CashUSA have an easy and quick payback approach. The borrower must make payments according to the loan terms and circumstances established with the lender. The borrower can set up automated payments to ensure on-time payments because the payments are made electronically.

Pros and Cons of CashUSA

| Pros | Cons |

|---|---|

| Quick and easy loan process | High-interest rates for some loans |

| Availability of loans up to $10,000 | Not available in all states |

| Excellent customer support | The loan terms and conditions vary depending on the lender |

Conclusion

CashUSA is a reputable and trustworthy online lending marketplace that may assist borrowers in swiftly and conveniently getting the money they require. CashUSA is a great alternative for people who need a loan but want to avoid dealing with the headache of traditional banks because of its speedy loan process, availability of loans up to $10,000, and good customer assistance.

3- MoneyMutual

With the help of MoneyMutual, borrowers can access a network of potential lenders online. The website makes it simple and quick for users to find short-term loans, frequently in only a few minutes after applying.

How Does MoneyMutual Work?

Borrowers must complete an online application form with basic information about their income, job situation, and credit history to qualify for a loan with MoneyMutual. The borrower can select the loan offer that best suits their needs once the website matches them with potential lenders.

It’s important to note that MoneyMutual is not a lender but rather a platform connecting borrowers with lenders. As such, borrowers should carefully review the terms and conditions of any loan offer they receive through the website and ensure they fully understand the interest rates, fees, and repayment terms before accepting a loan.

MoneyMutual Eligibility

- Be at least 18 years old

- Be a US citizen or permanent resident

- Have a valid checking account in your name

- Have a verifiable source of income

- Have a valid email address and phone number

You may only be granted a loan with MoneyMutual if you meet these requirements. Your application will be examined by lenders in the network, who will then decide if you qualify based on their standards.

How to apply for a loan through MoneyMutual

- Visit the MoneyMutual website and fill out the online application form.

- Provide your personal and financial information, including your name, address, Social Security number, employment information, and bank account information.

- Review the loan offers you receive from MoneyMutual’s network of lenders.

- Choose the loan offer that fits your needs and accept the loan agreement.

- Receive the loan funds in your bank account within a few business days.

Tips for getting approved for a loan through MoneyMutual

- Make sure you meet the eligibility requirements before applying for a loan.

- Fill out the application form accurately and completely.

- Provide verifiable employment and income information.

- Maintain a good credit score.

- Compare loan offers and choose the one with the most favourable terms.

Pros and Cons

| Pros | Cons |

|---|---|

| Fast and easy application process. | High interest rates and fees. |

| Wide network of lenders to choose from. | Short repayment terms. |

| Loan funds deposited directly into your bank account. | Not available in all states. |

Conclusion

A lending network called MoneyMutual can assist consumers in finding short-term loans swiftly and conveniently. Before accepting an offer, satisfying the eligibility conditions and carefully reviewing the loan terms are crucial. When used carefully, MoneyMutual can offer a financial lifeline in times of need, but it’s crucial to be aware of the risks and disadvantages.

No credit check payday loans guaranteed approval or guaranteed payday loan approval no credit check

Even though there is no credit check, it is essential to note that there is no such thing as a “guaranteed approval” payday loan. Lenders usually analyse numerous variables when deciding whether to grant a loan, such as your income, job history, and banking activity.

What is No Credit Check Loan and How Does it Work?

Credit check loans are typically used by borrowers with poor credit or no credit history, as they may need help to qualify for traditional loans requiring a credit check. These loans can be used for various purposes, such as unexpected expenses, car repairs, or medical bills.

FAQ (No Credit Check Loans Guaranteed Approval)

- Is MoneyMutual a lender?

No, MoneyMutual is not a lender. It is an online lending platform that connects borrowers with short-term lenders. - What is the maximum loan amount available through MoneyMutual?

The maximum loan amount available through MoneyMutual is $2,500. - How long does it take to receive loan funds through MoneyMutual?

Loan funds are typically deposited into your bank account within a few business days. - Can I apply for a loan through MoneyMutual if I have bad credit?

You can still apply for a loan through MoneyMutual, even with bad credit. However, lenders in MoneyMutual’s network may have their credit score requirements. - Is MoneyMutual a lender?

No, MoneyMutual is not a lender. It is an online lending platform that connects borrowers with short-term lenders. - Is MoneyMutual available in all states?

No. - Is CashUSA a direct lender?

No. - How much can I borrow from CashUSA?

Borrowers can request loans up to $10,000 through CashUSA. - How long does it take to get a loan through CashUSA?

Once the borrower has completed the loan request form, they can receive funds within 24 hours of approval. - What happens if I miss a payment of CashUSA?

If a borrower misses a payment, the lender may charge a late payment fee, which may negatively impact their credit score. - Is CashUSA safe and secure?

Yes, CashUSA is safe and secure. The company uses the latest encryption technology to ensure the safety and security of its borrowers’ personal and financial information. - What type of loan does not require a credit check?

- Payday loans

- Title loans

- Secured personal loans

- Some online lenders and credit unions

If you have any questions, please don’t hesitate to post them in the comment box.

If you are interested to learn programing language then you can checkout this website : codingwithtech.com

Thanks !