Fairness analysts from funding financial institution J.P. Morgan got here away from a current go to to corporations within the London insurance coverage and reinsurance market with the impression that underwriters really feel there may be loads of headroom left within the increased attachment factors nonetheless put in throughout the sector, regardless of inflationary influences on losses.

“We got here away from the tour with the sensation that the market continues to be in place; charges is perhaps beginning to weaken however they continue to be at extremely ample ranges with the potential for sturdy ROEs for a minimum of the following couple of years,” the analysts mentioned.

“We got here away from the tour with the sensation that the market continues to be in place; charges is perhaps beginning to weaken however they continue to be at extremely ample ranges with the potential for sturdy ROEs for a minimum of the following couple of years,” the analysts mentioned.Whereas pricing developments are slowing throughout reinsurance, the J.P. Morgan analyst workforce be aware that they continue to be at “very wholesome ranges”, saying that whereas reinsurance softened by means of 2024 “the image stays constructive total.”

“Whereas there was a softening in worth, it was thought of that phrases and circumstances remained sturdy and attachment factors have been nonetheless at engaging ranges,” the analysts reported.

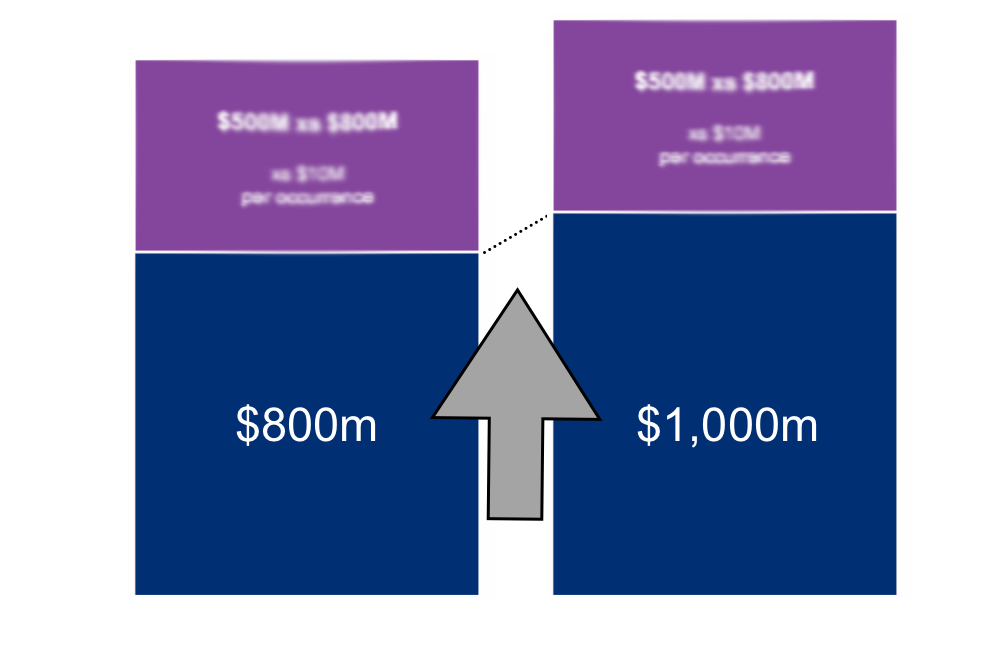

Saying, “We had been barely involved about whether or not the fabric enchancment in attachment factors had been eaten away by inflation however we got here away reassured that there’s nonetheless loads of headroom earlier than the rise in retentions disappears.”

In consequence, the London market insurance coverage and reinsurance constituents that J.P. Morgan’s analyst workforce met with are largely assured that engaging underwriting alternatives exist.

“The view was nearly common that given the speed adequacy of pricing, there have been prone to nonetheless be alternatives to develop and develop portfolios in 2025,” the analyst workforce defined.

The analysts highlighted of their report, that some attachment factors do get adjusted for inflation, which tends to lead to additional upwards motion given the final inflationary trajectory seen all over the world.

This resulted in attachments being “broadly flat in nominal phrases” on the 1/1 reinsurance renewals and the bulk are nonetheless at wholesome ranges, regardless of any inflationary influences.

The outlook for April 1st reinsurance renewals in Japan and South Korea had at all times been for a continuation of January’s softening pattern.

Evidently in some instances the Japanese charge softening has been maybe barely sooner than January, with some layers of towers seeing charge decreases within the double-digits, however total we’re advised the notion is that attachments have largely held once more and a few have been adjusted for inflation.

J.P. Morgan’s analysts mentioned that the sentiment in London throughout their current go to was that the current wildfires would possibly dampen worth softening on the US renewals on the mid-year.

As rate-on-line stagnates, or softens, it’s going to be extremely essential for underwriters to take note of the consequences of inflation on publicity and due to this fact guarantee attachments are being saved at adequate ranges.

It might be very simple to permit for the efficient attachment factors to come back down, as a lever for sustaining extra charge per unit of threat in property disaster reinsurance renewals.

However the market has been there earlier than, within the final softening cycle by means of the early to mid 2010’s, when there was little management of attachments and phrases or circumstances that in some instances brought about significant will increase within the likelihood that reinsurance layers connected.

Whereas there could also be loads of headroom in attachment factors at this stage and the market has appeared disciplined on this entrance, it’s essential that different phrases and circumstances should not weakened to the diploma that attachment threat rises unduly, whereas underwriters and insurance-linked securities (ILS) managers additionally must maintain a grip on inflation.

So many elements go into deriving a likelihood of attachment, for a reinsurance layer or an instrument comparable to a disaster bond. Inflation can undermine attachments if it’s not correctly measured, thought of and factored in.

However it’s additionally key to seize all types of inflation, by means of the publicity base but additionally within the financial system and the way every can have an effect on claims quantum, improvement and follow-on prices that may drive claims increased comparable to rebuilding.

Whereas headroom nonetheless exists right now, there’s no assure it can stay in a yr or two’s time if the market turns into more and more aggressive and aggressive at renewals, or falls again into its outdated behavior of putting the significance of securing volumes increased than sustaining profitability.