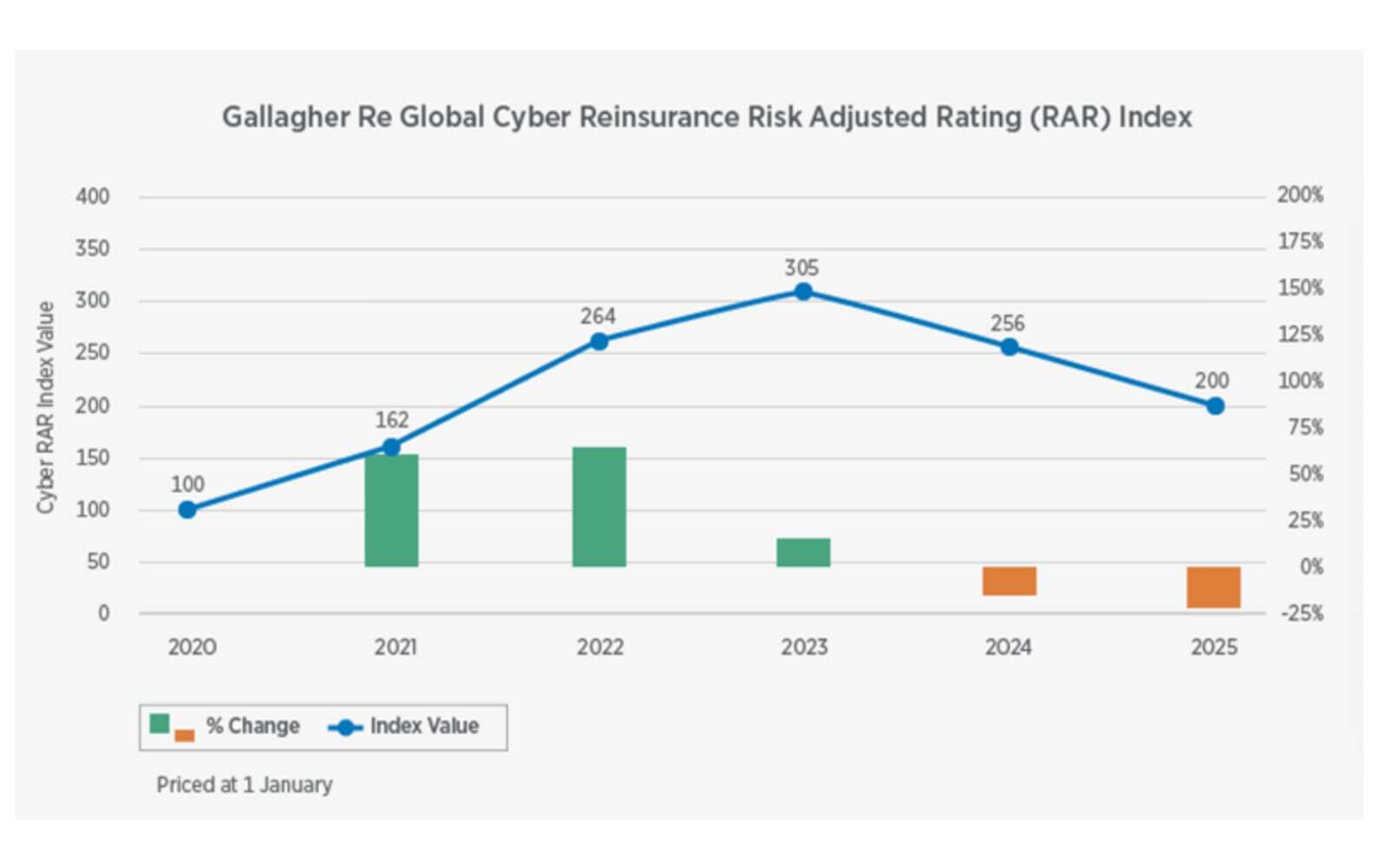

Reinsurance dealer Gallagher Re just lately launched its Cyber Threat Adjusted Score (RAR) Index, revealing that its worth was 100% increased on January 1st, 2025, in comparison with January 1st 2020, indicating increased rates-on-line, because the cyber market continues to develop amid an evolving threat panorama.

For these unaware, the Gallagher Re Cyber Threat Adjusted Score (RAR) Index is a measure of the change in reinsurance costs, adjusted for anticipated modifications to the underlying degree of threat.

For these unaware, the Gallagher Re Cyber Threat Adjusted Score (RAR) Index is a measure of the change in reinsurance costs, adjusted for anticipated modifications to the underlying degree of threat.Furthermore, the Cyber RAR Index worth noticed a notable enhance of 62% from 2020 to 2021, which was then adopted by a barely increased development of 63% between 2021 and 2022, reflecting the upper prices of cyber reinsurance on the time.

From 2022 to 2023, the expansion fee slowed significantly to 16%, earlier than shifting downward.

Then, from 2023 to 2024, the Index worth declined by 16%, and the downward pattern continued into 2024 to 2025, with an additional lower of twenty-two%.

As talked about, the Cyber RAR Index was 100% increased on January 1st 2025, in comparison with January 1st 2020, nevertheless it was 34% decrease than its peak on January 1st 2023.

Ian Newman, International Head of Cyber, commented: “Whereas it has carried out effectively in recent times, the cyber market continues to develop and the chance panorama is evolving quickly. Cyber can also be a CAT and systemically uncovered class and reinsurance consumers are always searching for appropriate and successfully priced non-proportional safety.”

“Gallagher Re subsequently imagine that over the long-term, an index of the Cyber Mixture Extra of Loss market will present a helpful and insightful barometer as to the state of the cyber reinsurance score surroundings,” he added.

In line with Gallagher Re, Mixture Cease-Loss and Mixture Extra of Loss constructions have remained the popular options since 2015, on account of their skill to cowl systemic cyber occasions, loss frequency traits, and hostile developments such because the rise in ransomware between 2018–2021.

It’s additionally necessary to keep in mind that the disaster bond market is now open to well-structured cyber dangers in excess-of-loss cat bond format, which remains to be a really small piece of the general cat bond market however anticipated to broaden.

Since their introduction to the insurance-linked-securities (ILS) market in 2023, we now have thus far seen 10 cyber cat bonds issued.

You may examine each cyber cat bond transaction, together with the primary personal cat bond offers and the more moderen 144A cyber cat bonds, by filtering our Deal Listing by peril to view solely cyber cat bond transactions.