Florida’s Residents Property Insurance coverage Company, the state’s insurer of final resort, is aiming to buy $2.94 billion of recent conventional reinsurance and disaster bonds for the 2025 hurricane season, which might take its whole danger switch to $4.54 billion this 12 months.

Florida Residents nonetheless has $1.6 billion of disaster bonds excellent to supply safety by means of the 2025 hurricane season.

Florida Residents nonetheless has $1.6 billion of disaster bonds excellent to supply safety by means of the 2025 hurricane season.There may be $1.1 billion of combination reinsurance restrict accessible from the Everglades Re II Ltd. (Sequence 2024-1) cat bond that Florida Residents sponsored in 2024, which is able to run by means of each the 2025 and 2026 wind seasons for the insurer.

As well as, Residents nonetheless has $500 million of industry-loss primarily based reinsurance from its Lightning Re Ltd. (Sequence 2023-1) cat bond that it sponsored in 2023 and which is able to present protection by means of the following hurricane season solely, maturing early subsequent 12 months.

The cat bond program has supplied the insurer with added certainty from its multi-year safety, on prime of which it can now enterprise into the market to safe further reinsurance or cat bonds as much as the focused $4.54 billion of restrict.

To safe the required danger switch and reinsurance safety for 2025, Florida Residents stated it’s budgeting for about $650 million of premiums.

For 2024, the insurer had budgeted $700 million initially, in comparison with a projection of $695.2 million for for 2023.

The decline in premium ceded that’s being budgeted for comes with the discount in publicity Florida Residents has skilled, as its depopulation program has taken higher impact within the final 12 months.

Due to this decreased stage of publicity, the 1-in-100 12 months PML is estimated at round $12.86 billion as of the tip of 2024, in comparison with an over $17 billion projection it had for that determine in late 2023.

Recall that, Florida Residents had reported its coverage rely as falling under 1 million by the tip of November 2024. That decline has continued, with the determine dropping to 847,571 insurance policies by the tip of February 2025 and so the exposure-base falling commensurately.

Florida Residents workers consequently suggest shopping for whole danger switch of $4.54 billion, with the $1.6 billion of in-force disaster bond safety and $2.94 billion of recent non-public danger switch, made up of each conventional reinsurance and disaster bonds.

A number of the conventional reinsurance may be from collateralized sources, because it’s typical that ILS funds take part in these layers as nicely.

Actually, at its 2024 renewal Florida Residents secured nearly $1.3 billion of safety that got here from insurance-linked securities (ILS) and collateralized markets participation in its conventional reinsurance tower.

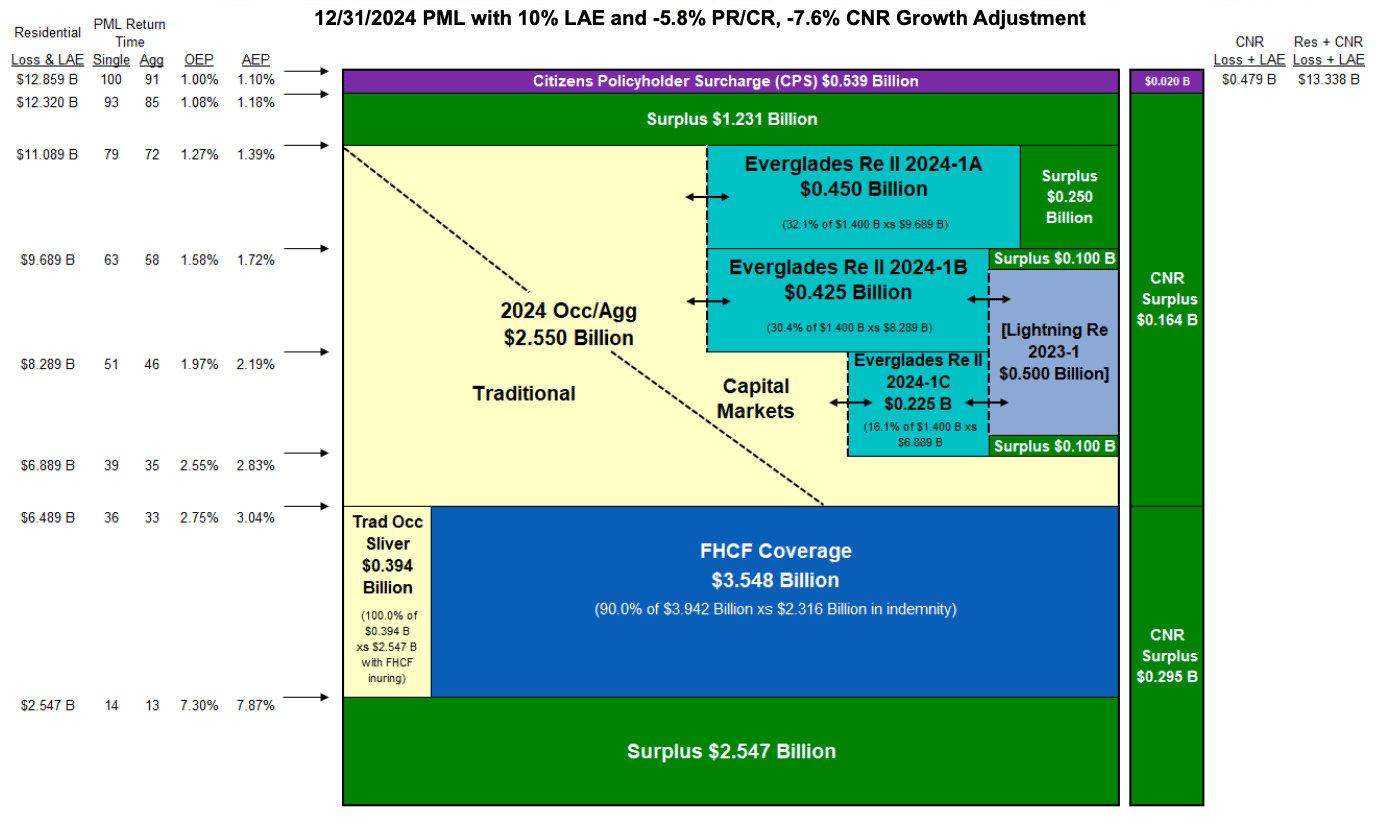

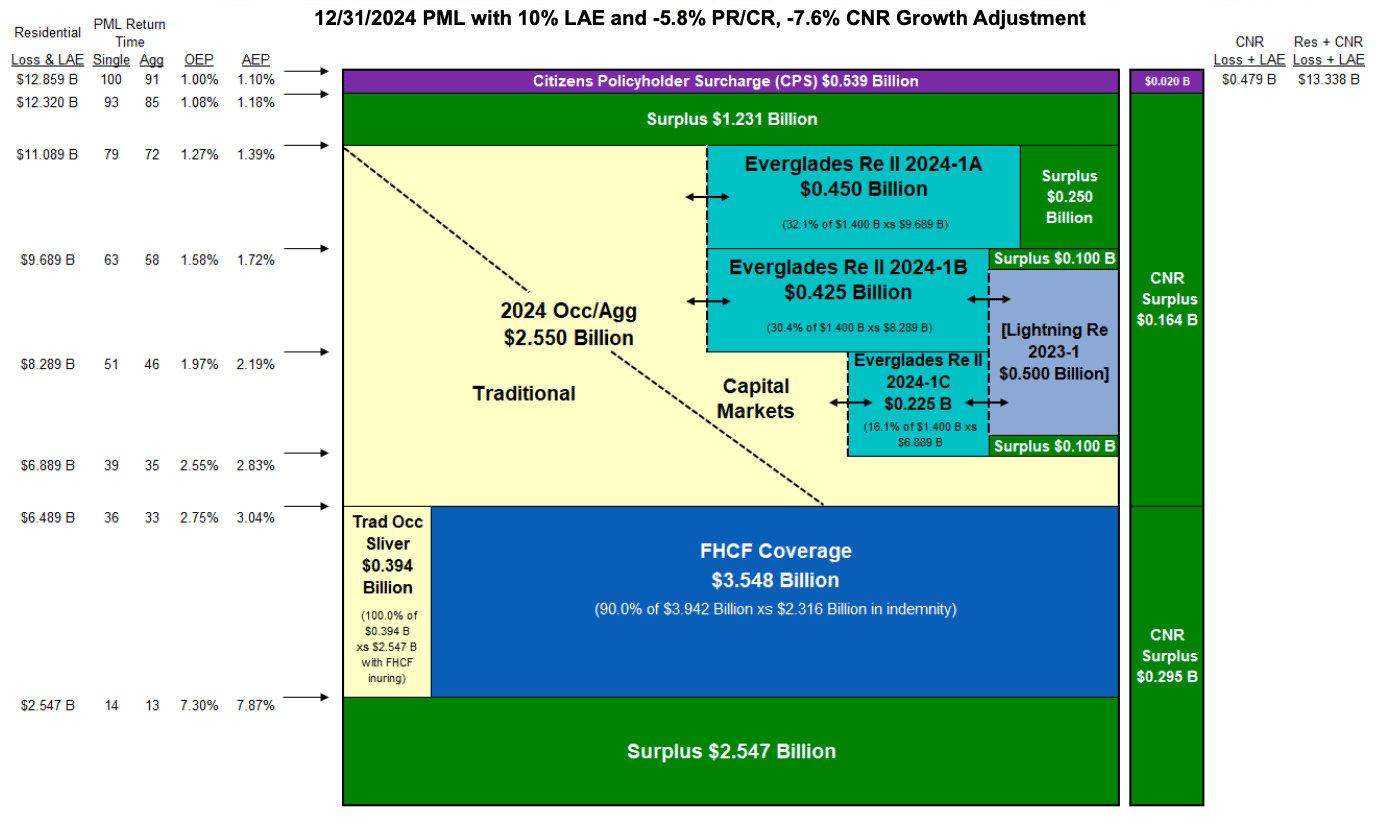

The 2025 danger switch tower is anticipated to function a conventional reinsurance sliver layer that sits alongside and works in tandem with the necessary protection supplied by the Florida Hurricane Disaster Fund (FHCF) amounting to $394 million.

FHCF protection is projected to be $3.548 billion in measurement, down on the $5.02 billion utilised for 2024, once more as a result of discount in publicity.

Above that may sit a layer that includes the $1.6 billion of in-force disaster bonds and roughly $2.55 billion of recent reinsurance and cat bonds procured for 2025, which is able to all be annual combination in nature.

You possibly can see the proposed 2025 danger switch tower for Florida Residents under:

Beneath the non-public market danger switch the excess has been eroded in comparison with final 12 months, successfully which means reinsurance cowl might connect from a projected $2.547 billion of losses in 2025.

At its 2024 reinsurance renewal, the Florida Residents tower had $3.154 billion of surplus sitting within the backside layer.

If Florida Residents is profitable in putting the focused $2.94 billion of recent reinsurance and cat bonds, giving it $4.54 billion of personal market danger switch, it says that it could expose all of its surplus and have a possible Residents policyholder surcharge of $559 million for a 1-in-100-year occasion in 2025.

Residents workers at the moment are partaking with brokers, advisors and market members to design, construction and worth its reinsurance and disaster bond placements for 2025.

It’s value remembering although, that Florida Residents had focused $5.5 billion of reinsurance and danger switch upfront of the 2024 hurricane season, however solely ended up shopping for slightly below $3.6 billion because it discovered pricing too excessive to maximise its safety final 12 months.

Residents defined that its proposed danger switch tower for 2025, “is structured to supply liquidity by permitting Residents to acquire reinsurance recoveries upfront of the fee of claims after a triggering occasion whereas decreasing or eliminating the possibilities of assessments and preserving surplus for a number of occasions and/or subsequent seasons.”

Given the enticing execution seen within the disaster bond marketplace for latest deal sponsors, it’s anticipated that Florida Residents might come to market with one other massive new issuance within the coming weeks.