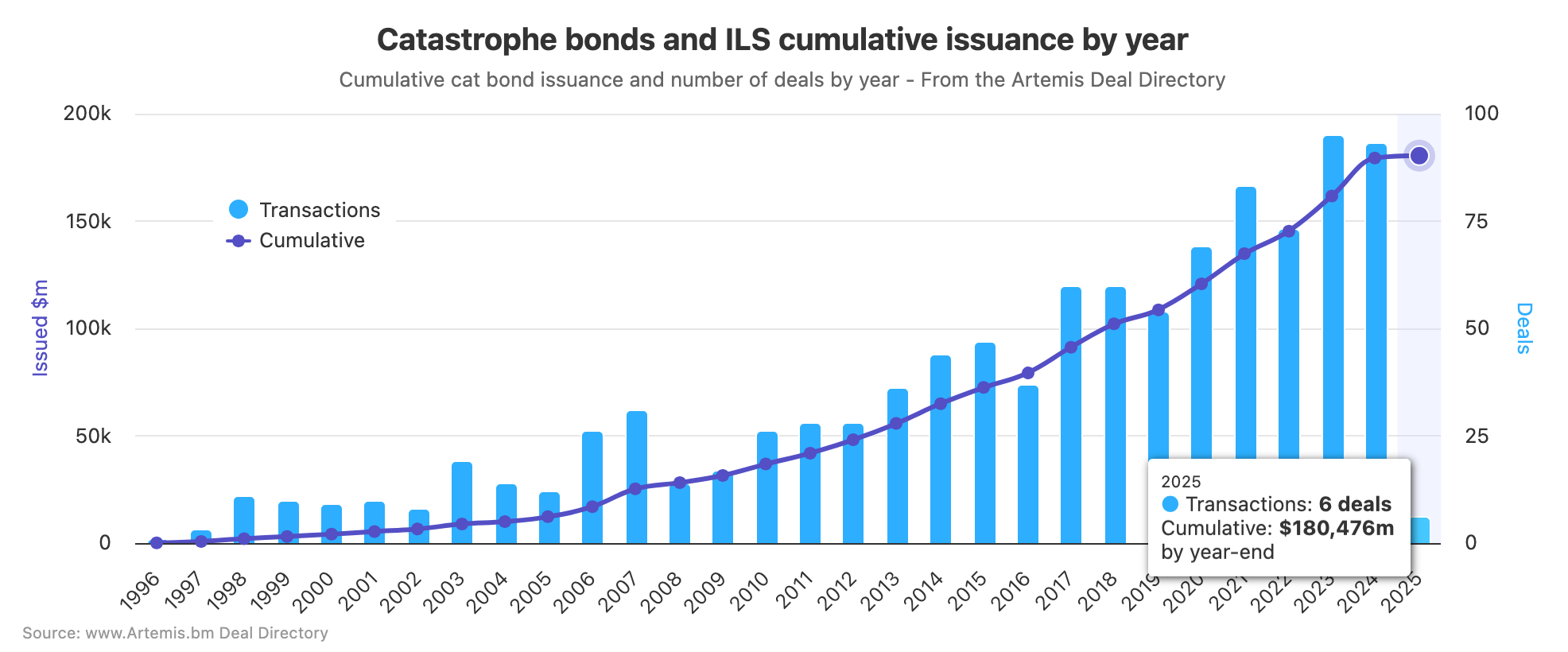

Because the very first deal got here to market nearly three many years in the past, the cumulative worth of disaster bonds and associated insurance-linked securities (ILS) we’ve analysed and tracked has now surpassed $180 billion of issuance, in line with our Artemis Deal Listing.

This can be a new milestone for the disaster bond and associated insurance-linked securities (ILS) market and comes after the second consecutive 12 months of document issuance and a busy begin to 2025.

File issuance of $16.4 billion from 95 transactions in 2023 was damaged final 12 months as 93 transactions introduced a mixed $17.7 billion of latest danger capital to market. The truth is, since 2017, cat bond and associated ILS issuance has solely as soon as did not breach $10 billion, in 2019 when it totalled $6.5 billion.

This spectacular development has seen the market develop significantly. Cumulative issuance solely surpassed $100 billion in mid-2018, earlier than leaping to greater than $120 billion in 2020 and surpassing the $150 billion mark in 2023.

After a mixed greater than $34 billion of issuance in 2023 and 2024, cumulative issuance ended final 12 months simply shy of $180 billion however has now handed this milestone after greater than $1 billion of settled issuance already in January 2025.

The chart above is one in all many charts obtainable as a part of the Artemis information service, enabling evaluation of the cat bond and ILS sector in better element. It exhibits simply how sturdy market development has been through the years, notably since 2017.

Whereas a lot of the expansion has come from repeat sponsors, it’s price highlighting that over the previous three years, Artemis’ information means that greater than 40 new sponsors have entered the market.

Thus far this 12 months, greater than $1 billion of reinsurance or retrocession safety has been secured from the capital markets by way of cat bond issuances, and this additionally features a new sponsor.

What’s extra, the Artemis Deal Listing exhibits that there’s at present one other $1.82 billion within the pipeline scheduled to finish earlier than the top of February, and with the potential for extra transactions to look earlier than the top of Q1, it appears set to be one other busy opening quarter for the market.

As we’ve mentioned beforehand and in our This autumn and full 12 months 2024 disaster bond and associated ILS market report, cat bond spreads have come down from the highs of 2023, however they clearly stay engaging to buyers and likewise new and previous sponsors as exercise stays strong and retains pushing the boundaries of the area.

The Artemis Deal Listing lists all disaster bond and associated transactions accomplished because the market was fashioned within the late 1990’s. The listing additionally lists the cat bonds ready to settle, that are highlighted in inexperienced on the prime of the listing.

Obtain our free quarterly disaster bond market reviews.

We observe disaster bond and associated ILS issuance information, probably the most prolific sponsors available in the market, most lively structuring and bookrunning banks and brokers, which danger modellers function in cat bonds most regularly, plus a lot extra.

Discover all of our charts and information right here, or by way of the Artemis Dashboard which offers a helpful one-page view of cat bond market metrics.

All of those charts and visualisations are up to date as quickly as a brand new cat bond issuance is accomplished, or as older issuances mature.